B2B SaaS Marketing: how to estimate lifetime value for startups

Estimated Lifetime Value (eLTV) is one of the most important metrics in guiding marketing spending and efforts in B2B SaaS marketing – as well as predicting how far you might expect to get on a given budget. It’s what will dictate your acceptable customer acquisition cost (CAC), and thus how much your willing to spend on a lead – your CPL (cost per lead). Calculating LTV involves a lot of number-crunching for the most established of companies. So what can you do as a startup or scaleup, where you probably have to rely on limited (both in time and relevance) historical data?

Keep the goal in mind

In B2B SaaS marketing, it’s crucial to be clear on why you are calculating your LTV at this point in time. Your only goal should be, in truth, to build a functional growth engine that can provide leads and deals at a cost and velocity that aligns with your unit economics and company goals. This makes historical data largely irrelevant, as your most important metrics are still in the process of improvement. Let’s dive into exactly what we mean by that.

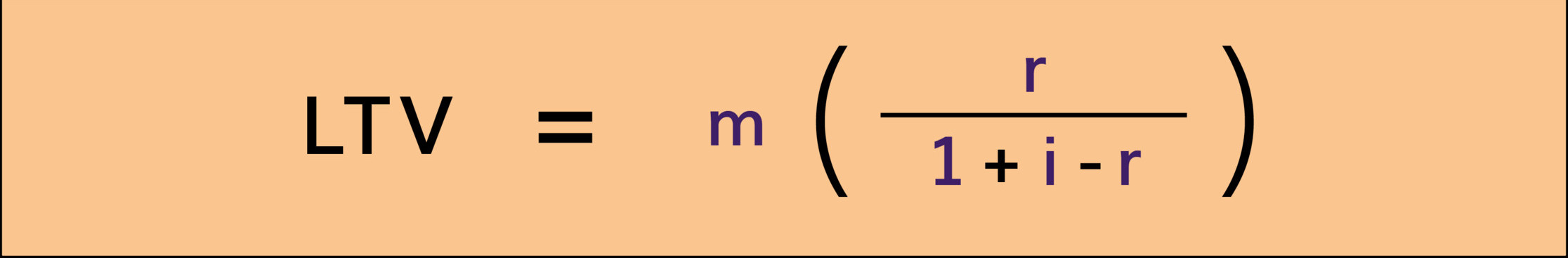

The traditional LTV formula

A common lifetime value you’ll encounter is based on your Average Margin (m), Retention Rate (r), and your Discount Rate (i). This makes sense when you have an abundance of data, but also predominantly when you consider customer relationship length as a factor which you have little control over. Why? Retention Rate does not entail a length of relationship, rather your probability of retaining your customer’s business. In the end though, the whole part of the formula between brackets ends up as the multiplier of your margin, without taking into account how long you are able to keep clients on board for. Time is simply not a factor in this formula – which makes sense for some low-value SaaS subscriptions, eCommerce, and other consumer industries. But much less so for SMB and enterprise SaaS.

The limited data challenge

Another issue in B2B SaaS marketing is that Discount- and Retention Rates for startups and scaleups are often unknown or based on too little data. Moreover, they’re likely to evolve wildly en quickly as you’re most likely experimenting continuously with pricing and retention iterations, narrowing in on your ICP (which impacts both) and shipping new features, plans, even modules.

At this point, it becomes clear that there are severe drawbacks to this approach for young, growing companies.

Estimated LTV: a predictive, goal-based approach

What’s the solution, then? Adopting a predictive approach. Rather than looking at predictive data, use metrics you should be aiming for regardlessly. E.g., your Discount Rate should never be too high – let’s say that in your market segment, it makes sense to aim for 10% at best. After all, this dictates whether your unit economics will work out or not. Any discount rate above what makes your efforts profitable needs to be avoided. It’s therefore important to align your growth/sales team on this hard rule, but that’s all it takes to make this metric perfectly controllable.

The same thing goes for retention rate. Given the combination of a lack of historical data and the unfixed nature of retention for startups especially, it does not make sense to use your current retention rate in your formula. Better to set a realistic aim for the time (remember, we wanted to factor this parameter in) you wish to retain a customer and set OKRs for your team to actually hit that goal. Getting churn under control is crucial for any SaaS company. Not using a target retention time rather than a (potentially suboptimal) actual one, can lead you to underinvest or focus on lowering CAC rather than improving retention.

Finally, it’s key to keep in mind what your upfront budget and expected payback time is. This all feeds into your expected retention time: to be safe, adjust it downwards in your formula as an overly optimistic number can lead you to overspend, or not give your team enough time to improve retention before you’re out of runway.

OK, just give me the formula already

Hear, hear. Here you go. This is how to calculate your Estimated LTV:

t = Retention Time

m = Average Margin

i = Discount Rate

Some practical tips on how to use this formula

Retention Time

For yearly subscriptions, a useful benchmark for Retention Time is three years. If you are not able to keep customers subscribed for 3 years on average, something is wrong, and you need to work on it urgently. It’s little more than a rule of thumb, but helps you get where you need to go.

Discount Rate

Keep in mind that if you discount heavily in your first year, you’ll want to spread out your Discount Rate (like an amortization) over the duration of the retention time. So if you discount 30% in year 1 but not at all or a negligible amount in year 2 and 3, your discount rate should be 0,1. It’s imperfect, but provides an acceptable view of what you’ll be making on an average deal.

Average Margin

This, to be clear, is simply your margin rate multiplied by your average margin as expressed in your respective currency. Note that as your startup grows, your margin ever approaches 90-95% due to the inherent economies of scale that SaaS companies can achieve. Even in the early stages, or in hard times, 80% should at the very least be possible. So again, do not aim for anything less than 0.8 of your average deal size. If you are not currently at that point, you’ll need to improve on that, rather than let it impact your estimated LTV.

In conclusion

In B2B SaaS marketing, startups need LTV calculations that suit their reality, not cookie-cutter solutions. The right calculation matters, as it will dictate so many of your other metrics. Estimated LTV offers startups a you clarity on which metrics impact your unit economics if you use this calculation – from which you can retrofit very clear OKRs for your product and growth teams. Now go and generate some leads!